SMSF Collectables and Personal Use Assets

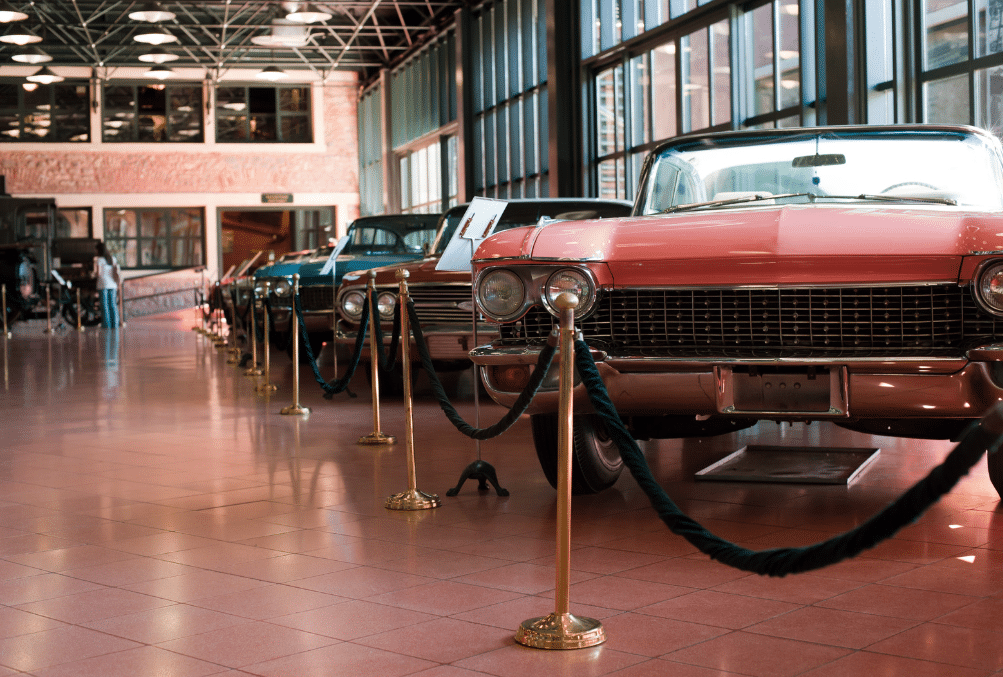

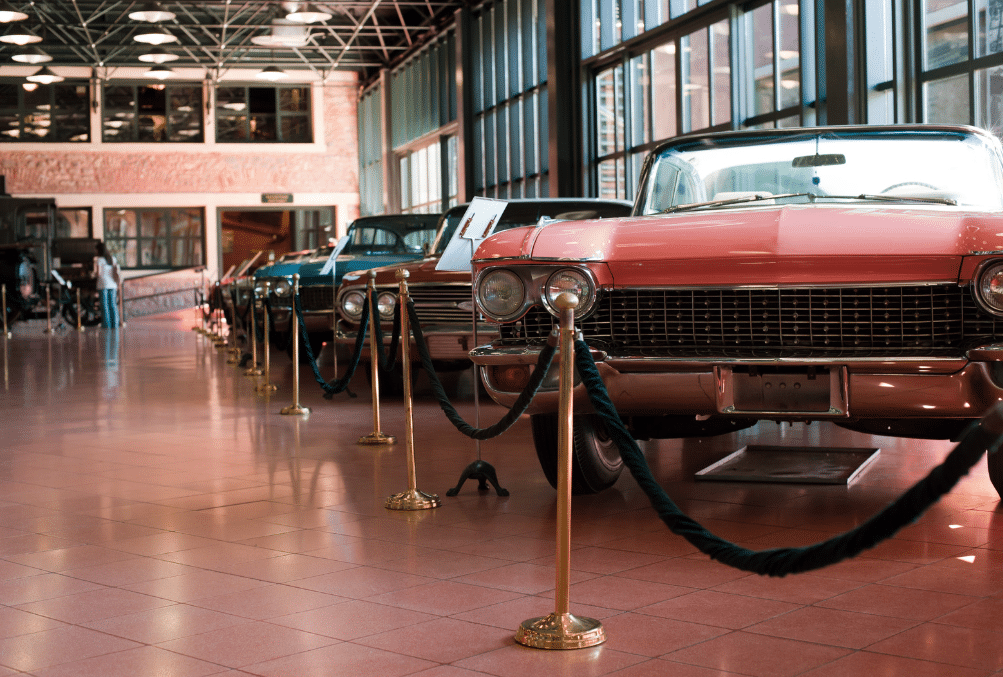

What are Collectables and Personal Use Assets? Collectables and personal use assets are investments typically enjoyed for personal pleasure or everyday use. However, when acquired

What are Collectables and Personal Use Assets? Collectables and personal use assets are investments typically enjoyed for personal pleasure or everyday use. However, when acquired

More and more older Australians are seeing the benefits of selling the family home in favour of a smaller home or an apartment. To facilitate

Property valuations are basically appraisals of property widely used to form an audit opinion about the investment. Regulation 8.02B of SISR requires valuation of all

In the realm of superannuation, case law has a significant influence on how advisers, investors and auditors operate. In 2018, the outcomes of two court

Several changes were made to Superannuation from 1 July 2021 which may impact the audit of your SMSF clients this financial year. SMSF auditors and

Recently the maximum number of members to form part of a self-managed superannuation fund (SMSF) and small APRA funds was increased from four to six.

There are only a few weeks before the 1 July changes to auditing standards come into effect, with in-house audits at risk of not complying

Written by SMSF Audit Manager James Song. With the “COVID-19 Early Release of Super” program ending on 31st December 2020, the ATO has advised that

For smaller firms unable to specialise in SMSF audits, there are real challenges in providing these services in a truly independent manner.

At National Audits Group we take pride in the quality of service provided and the results we deliver. Grow faster and further in confidence! Our expertise will help to take you there.

At National Audits Group we take pride in the quality of service provided and the results we deliver. Our vision is to be recognised and respected as the leading provider of quality assurance and advisory services.

© 2021 National Audits Group ABN 89 128 381 920

Liability limited by a scheme approved under Professional Standards Legislation

Privacy Policy | Website Designed by Simple Pixels