What are Collectables and Personal Use Assets?

Collectables and personal use assets are investments typically enjoyed for personal pleasure or everyday use. However, when acquired by a super fund, they must serve genuine retirement purposes and comply with the sole purpose test, providing no present-day benefits. These assets, known as SMSF collectables and personal use assets, must be managed carefully to ensure compliance and maximise benefits.

Specific Examples of SMSF Collectables and Personal Use Assets

- Artwork (including paintings, sculptures, and reproductions)

- Wines or spirits

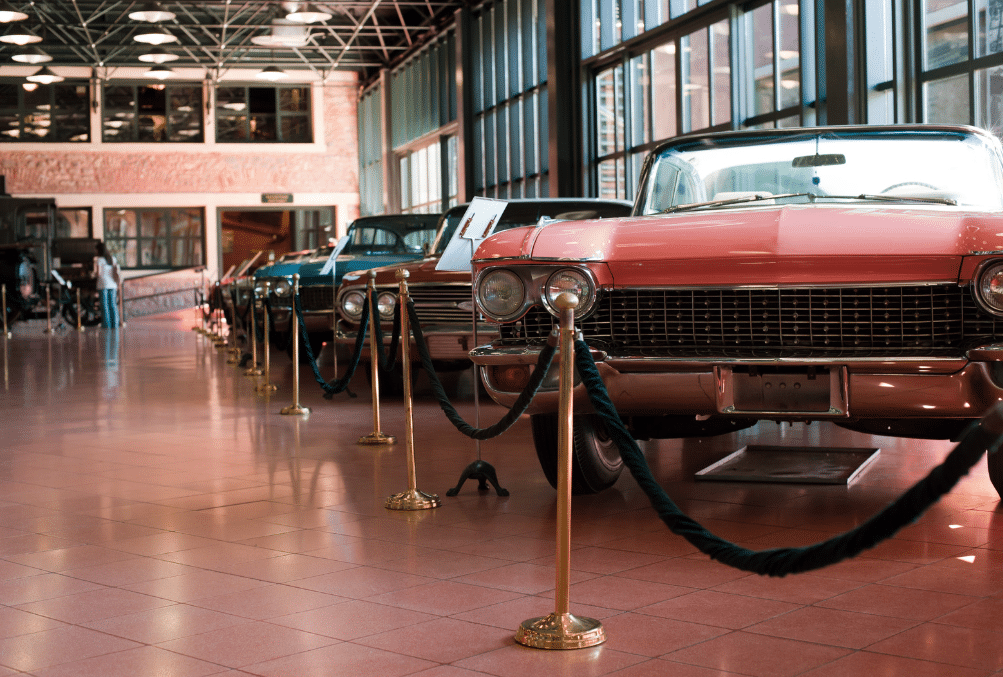

- Motor vehicles and motorcycles

- Memberships of sporting or social clubs

- Postage stamps or first day covers

- Antiques

- Coins, medallions, or banknotes

– Coins and banknotes are collectables if their value exceeds their face value

– Bullion coins are collectables if their value exceeds their face value, and they are traded at a price above the spot price of their metal content

At the end of June 2023, Australian SMSFs (Self-Managed Superannuation Funds) held $566 million in SMSF collectables and personal use assets. This represents less than 0.1% of the total SMSF assets, which amounted to $876.4 billion, according to the Australian Taxation Office (ATO).

Benefits of SMSF Collectable and Personal Use Assets

Investing in collectables, permitted by an SMSF’s trust deed and investment strategy, can diversify investments and spread risks. Additionally, some collectables appreciate over time, potentially increasing capital growth.

SMSFs also benefit from tax concessions, such as a lower tax rate on income and capital gains. These concessions can be particularly advantageous when collectables significantly appreciate in value.

Risks of SMSF Collectable and Personal Use Assets

Investing in collectables must solely enhance retirement savings. Violating the sole purpose test can result in the super fund being taxed at the highest marginal tax rate, losing compliance status, and exposing individual trustees to civil and criminal penalties, including fines and imprisonment. Corporate trustees face even higher penalties.

Proper storage and insurance of collectables can be costly, reducing the overall return on investment. Valuing these assets can also be subjective, leading to potential disputes with the ATO, which may affect an SMSF’s compliance and tax status.

For the 2022 financial year of audits, SMSF auditors reported 240 contraventions for funds breaching the collectable rules as of September 20, 2023.

ATO Rules for SMSF Collectables and Personal Use Assets

Display or Storage

Collectables and personal use assets cannot be stored in the private residence of any related party. This includes all parts of a private dwelling, such as garages or sheds. They can be stored (but not displayed) in premises owned by a related party, provided it is not their private residence.

Insurance

The fund must insure collectables and personal use assets in its name within seven days of purchase. Being the policy owner demonstrates the super fund’s ownership, safeguards assets against monetary loss or liability, and ensures insurance proceeds are payable directly to the fund.

Usage and Lease

Collectables and personal use assets must not provide a present-day benefit. Therefore, members or related parties cannot use these assets. For instance, if the SMSF owns a vintage car, a member or related party cannot drive it, even for maintenance or restoration.

These assets can only be leased to an unrelated party, and the lease must be on arm’s length terms.

Selling

Collectables and personal use assets can be illiquid, posing challenges when accessing funds in the SMSF. However, they can be sold to a related party at market price, as determined by a qualified independent valuer.

Market Value

Regularly valuing collectable assets ensures they are recorded at their market value, which requires a qualified independent valuer.

A valuer must either hold formal valuation qualifications or be considered knowledgeable, experienced, and judicious by their professional community. Moreover, the valuer must be independent of the fund’s interests, meaning they should not be a member of the fund or a related party (e.g., an investment partner).

Investing in collectables and personal assets requires understanding all rules to avoid breaches that may lead to tax implications and penalties. Trustees should consider investing in assets they know well and seek professional help to maintain SMSF compliance and ensure retirement income growth.

Partner with National Audits Group

At National Audits Group, we specialise in helping accounting practices manage SMSFs efficiently. We assist trustees in achieving their retirement goals and ensuring compliance with all relevant regulations. Reach out to us to experience our excellent service through approachable and pragmatic audits.

Renzel Robinos , Auditor, National Audits Group

References

- ATO Valuation Guidelines for Self-Managed Super Funds

- ATO Restrictions on Investments

- Grow SMSF Collectables

- SMSF Australia Collectables

- SuperGuide SMSF Investment

- SMSF Adviser Collectable Super Assets